Navigating the Landscape of SBA EIDL: A Comprehensive Guide to Policy and Resources

Related Articles: Navigating the Landscape of SBA EIDL: A Comprehensive Guide to Policy and Resources

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Landscape of SBA EIDL: A Comprehensive Guide to Policy and Resources. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of SBA EIDL: A Comprehensive Guide to Policy and Resources

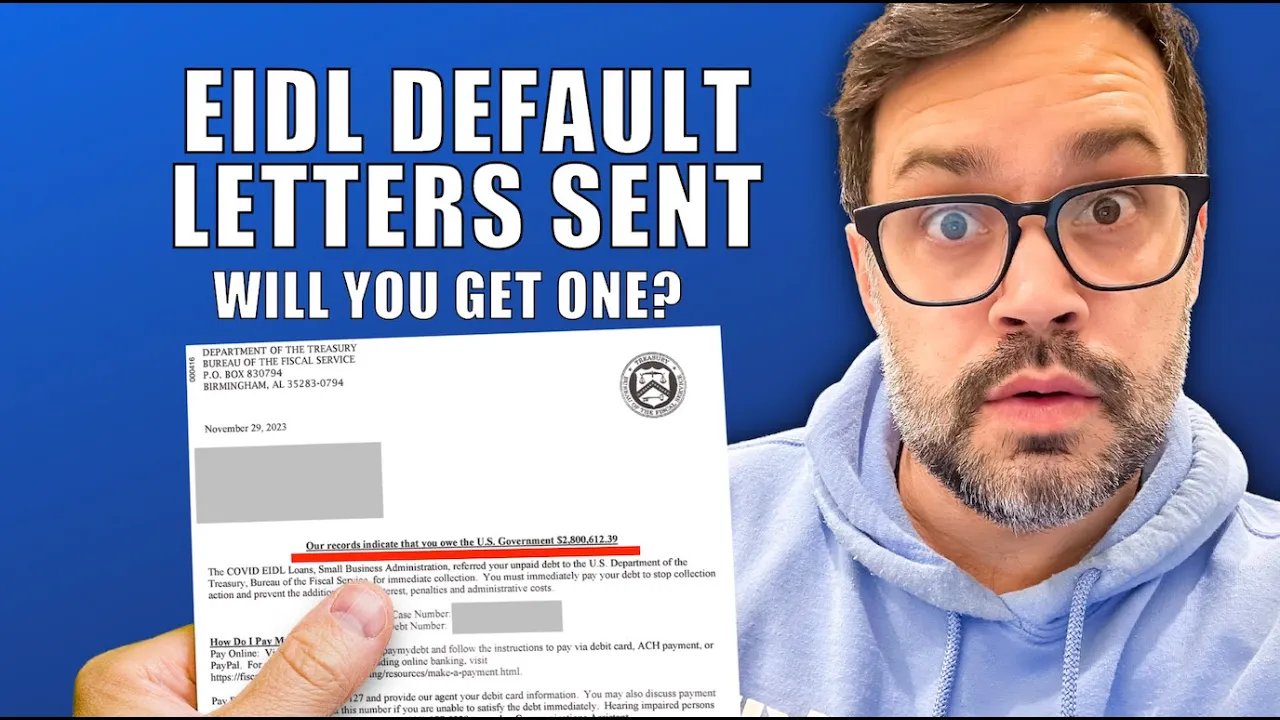

The Small Business Administration (SBA) Economic Injury Disaster Loan (EIDL) program has been a lifeline for countless businesses facing financial hardship, particularly during times of economic distress like the COVID-19 pandemic. Understanding the complexities of EIDL policies and accessing relevant resources is crucial for businesses seeking this vital financial assistance. This article aims to demystify the EIDL landscape by providing a comprehensive overview of its key policies and available resources.

EIDL Policy Map: A Visual Representation of EIDL Programs

The EIDL program encompasses a range of loan products and assistance options, each tailored to specific needs and circumstances. Navigating this diverse landscape can be challenging, which is where the "EIDL Policy Map" comes into play. This map, while not an official SBA document, is a powerful tool for visualizing and understanding the various EIDL programs and their associated policies.

Key Components of the EIDL Policy Map:

- Loan Types: The EIDL program offers several loan types, including:

- Economic Injury Disaster Loans (EIDLs): Designed to provide working capital to businesses experiencing economic injury due to a declared disaster.

- Targeted EIDLs: Specifically targeted towards certain industries or regions impacted by a disaster.

- Bridge Loans: Short-term loans to help businesses bridge cash flow gaps while awaiting approval for a larger EIDL.

- EIDL Advance: Grants of up to $10,000, available to eligible businesses impacted by the COVID-19 pandemic.

- Eligibility Criteria: Each EIDL program has specific eligibility criteria, which typically include:

- Business Size: The business must meet SBA size standards for eligibility.

- Location: The business must be located in a declared disaster area.

- Financial Need: The business must demonstrate a financial need for the loan.

- Credit History: The business must have a satisfactory credit history.

- Loan Terms: The EIDL program offers flexible loan terms, including:

- Interest Rates: Interest rates vary depending on the loan type and the borrower’s creditworthiness.

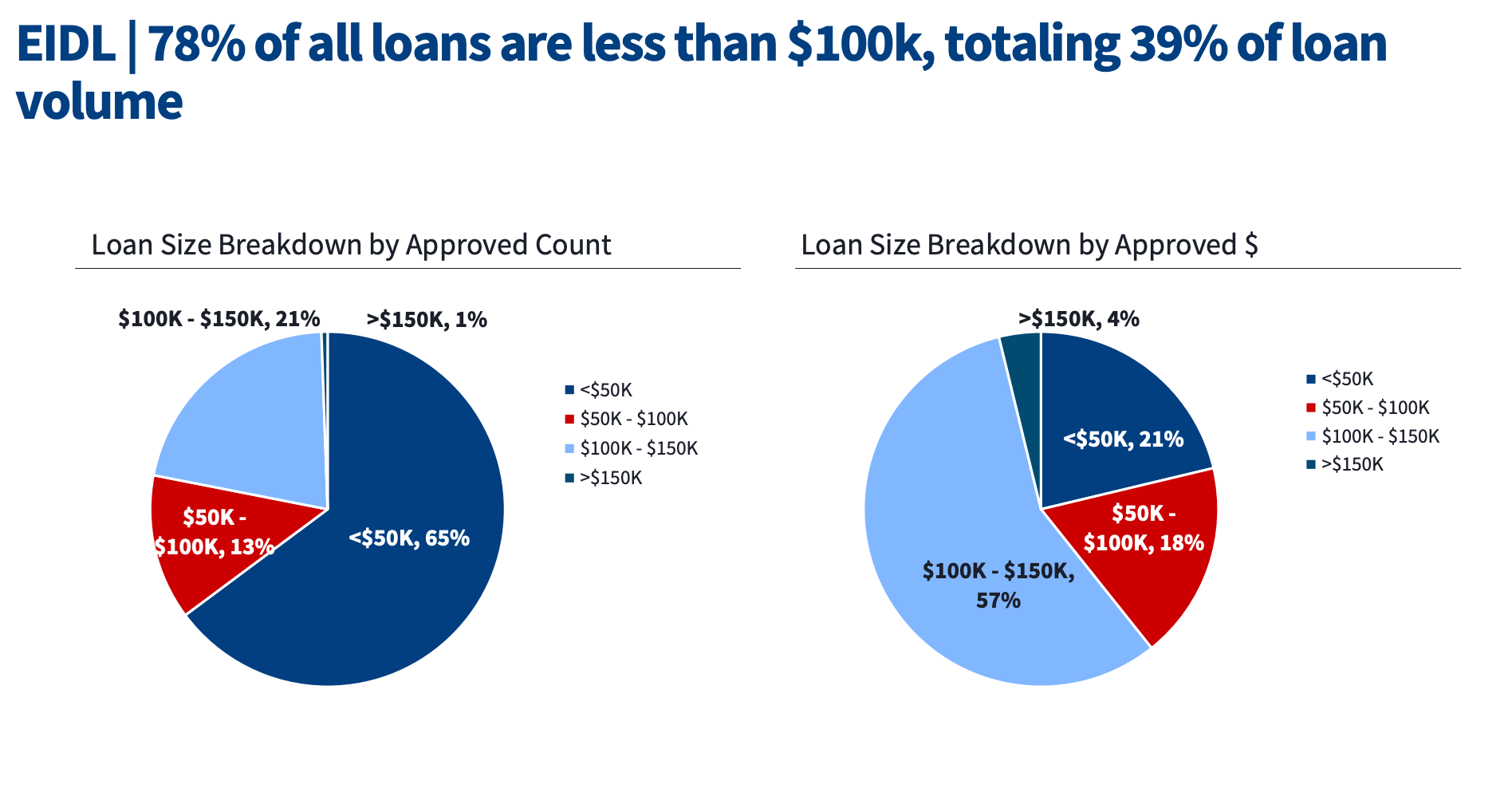

- Loan Amounts: Loan amounts are determined based on the business’s need and the SBA’s lending guidelines.

- Repayment Periods: Repayment periods can range from 30 years for EIDLs to shorter terms for Bridge Loans.

- Application Process: The EIDL application process is straightforward and can be completed online through the SBA’s website.

- Resources: The SBA provides a wealth of resources to assist businesses in navigating the EIDL program, including:

- SBA Website: The SBA website contains comprehensive information about EIDL programs, application requirements, and eligibility criteria.

- SBA Resource Partners: The SBA collaborates with various organizations, including lenders, non-profit organizations, and government agencies, to provide support to businesses seeking EIDL assistance.

- SBA Disaster Assistance Centers: The SBA operates Disaster Assistance Centers in disaster-affected areas to provide in-person assistance to businesses seeking EIDL loans.

Benefits of Understanding the EIDL Policy Map

A thorough understanding of the EIDL Policy Map is essential for businesses seeking EIDL assistance. It provides clarity on the following:

- Eligibility for Specific Loan Types: The map helps businesses identify which EIDL programs they may be eligible for based on their specific needs and circumstances.

- Application Process: The map outlines the steps involved in the EIDL application process, ensuring a smooth and efficient application experience.

- Loan Terms and Conditions: The map clarifies the loan terms and conditions associated with each EIDL program, enabling businesses to make informed decisions about their financing options.

- Available Resources: The map highlights the various resources available to businesses seeking EIDL assistance, including SBA website information, resource partners, and Disaster Assistance Centers.

FAQs about EIDL Policy Map

1. What is the purpose of the EIDL Policy Map?

The EIDL Policy Map serves as a visual guide to understanding the different EIDL programs, their eligibility criteria, loan terms, and available resources. It helps businesses navigate the complexities of the EIDL program and find the most suitable financial assistance for their specific needs.

2. Is the EIDL Policy Map an official SBA document?

No, the EIDL Policy Map is not an official SBA document. It is a tool created to simplify the understanding of EIDL programs and their associated policies. However, the information presented on the map is based on official SBA guidelines and regulations.

3. How can I access the EIDL Policy Map?

The EIDL Policy Map is not a readily available document from the SBA. It is often presented as a visual aid during workshops, webinars, or presentations related to EIDL programs. However, the information contained within the map can be gathered from official SBA resources, such as the SBA website and SBA Resource Partners.

4. What are the benefits of using the EIDL Policy Map?

The EIDL Policy Map provides a visual representation of the EIDL program, making it easier to understand the different loan types, eligibility criteria, loan terms, and available resources. This clarity helps businesses make informed decisions about their financing options and access the most appropriate EIDL program for their specific needs.

Tips for Utilizing the EIDL Policy Map

- Thorough Research: Before using the EIDL Policy Map, conduct thorough research on the EIDL program, including its eligibility criteria, loan terms, and application process.

- Consult with SBA Resource Partners: Seek guidance from SBA Resource Partners, such as lenders, non-profit organizations, and government agencies, to understand the EIDL program and its application process.

- Utilize the SBA Website: The SBA website is a valuable resource for information about EIDL programs, including application forms, eligibility guidelines, and loan terms.

- Contact the SBA Disaster Assistance Center: If you are in a declared disaster area, contact the SBA Disaster Assistance Center for in-person assistance with your EIDL application.

Conclusion

The EIDL program is a valuable resource for businesses facing financial hardship, particularly during times of economic distress. Understanding the complexities of EIDL policies and accessing relevant resources is crucial for businesses seeking this vital financial assistance. The EIDL Policy Map, while not an official SBA document, serves as a powerful tool for visualizing and understanding the various EIDL programs and their associated policies. By utilizing the EIDL Policy Map and consulting with SBA resources, businesses can navigate the EIDL landscape and access the most suitable financial assistance for their specific needs.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of SBA EIDL: A Comprehensive Guide to Policy and Resources. We appreciate your attention to our article. See you in our next article!